When Should You Hire a Contractor vs. Employee?

In order to stay competitive in today’s gig economy, both startups and established companies alike are faced with the need to understand their hiring options. As the gig economy continues to grow, companies are faced with a dilemma: Do you hire an employee or do you hire an independent contractor, freelancer, or gig worker?

It’s common to think that you’ll save money by hiring an independent contractor instead of an employee, but that may not be the case. You might have heard horror stories about employers getting in trouble for misclassifying employees as contractors or visa versa. While it is possible to get into legal trouble if you make a mistake, there are steps you can take to protect yourself from this issue and ensure your business is compliant. This article will cover when to utilize different hiring classifications and how each will affect your bottom line.

Why does classification matter?

Before we can discuss the differences between hiring contractors and employees, it’s necessary to understand why the different classifications exist. Recent technological and social advancements have made classification more important than ever before.

In an era of globalization and digital connectivity, gigs are the new gold. Many businesses are finding that hiring remote workers and contractors is more advantageous than ever before. The benefits of hiring contractors are clear: you can source your talent from across the globe, lower company costs, and boost efficiency in a multitude of ways. However, companies can only legally hire contractors if the worker or service provider meets certain legal criteria.

The gig economy is exploding and so is the confusion

According to Statista, “In 2023, the projected gross volume of the gig economy is expected to reach 455.2 billion U.S. dollars.” This amount is nearly double what they reported the gig economy to be in 2019. It’s clear that gig economy is taking off, but with great perks come great responsibilities.

In a way, the gig economy is a difficult and controversial topic to discuss. The rapid advancement in technology has made it increasingly hard for people to understand exactly what counts as part of the gig economy. Many workers find themselves surprised by how much freedom freelancing offers while others find themselves frustrated with the lack of protections afforded them under the law if something goes wrong.

When thinking about the gig economy, the main businesses that often come to mind are rideshare or delivery apps like Uber and DoorDash. However, contract work is much bigger than these platforms. Companies such as Upwork are making the utilization of contingent workforces and freelance talent simple and practical. When it comes to expert talent, Toptal and We Are Rosie are two examples of talent marketplaces known for their top-tier freelance talent.

Legal action around worker misclassification is increasing

The distinction between classifying a worker as an employee or freelancer is significant. Employers face various legal ramifications for the way they classify their workers, and there are numerous factors that must be considered when determining whether a job should fall under one category or the other.

As of the beginning of 2022, the National Labor Relations Board (NLRB) and the Department of Labor, Wage and Hour Division’s (DOL/WHD) have entered into a Memorandum of Understanding. This means that they will be sharing information more and working together to enforce federal laws that protect workers’ rights. The NLRB explains that this Memorandum will help the agencies with “better enforcement against unlawful pay practices, misclassification of workers as independent contractors, and retaliation against workers who exercise their rights.”

Since classification greatly affects both workers and employers, the federal government is making moves to create classification regulation to protect workers. Misclassification leads to workers not receiving the benefits they are entitled to as a result of businesses not paying for such benefits as health insurance, vacations, and sick days.

Financial savings such as these make gig workers are an attractive hiring option. However, someone isn’t necessarily a gig worker, freelancer, or contractor just because they are working remotely or for a short period of time. The next section will cover when to know how to classify your hires as employees or freelancers.

When do I hire a contractor vs. employee?

The first thing to understand about this topic is that you cannot simply decide which classification you want to use or which works best for your budget. For example, if you misclassify workers by calling them independent contractors but they really act like employees in practice, then you can get into trouble because the IRS will not allow employers to evade taxes using such tactics.

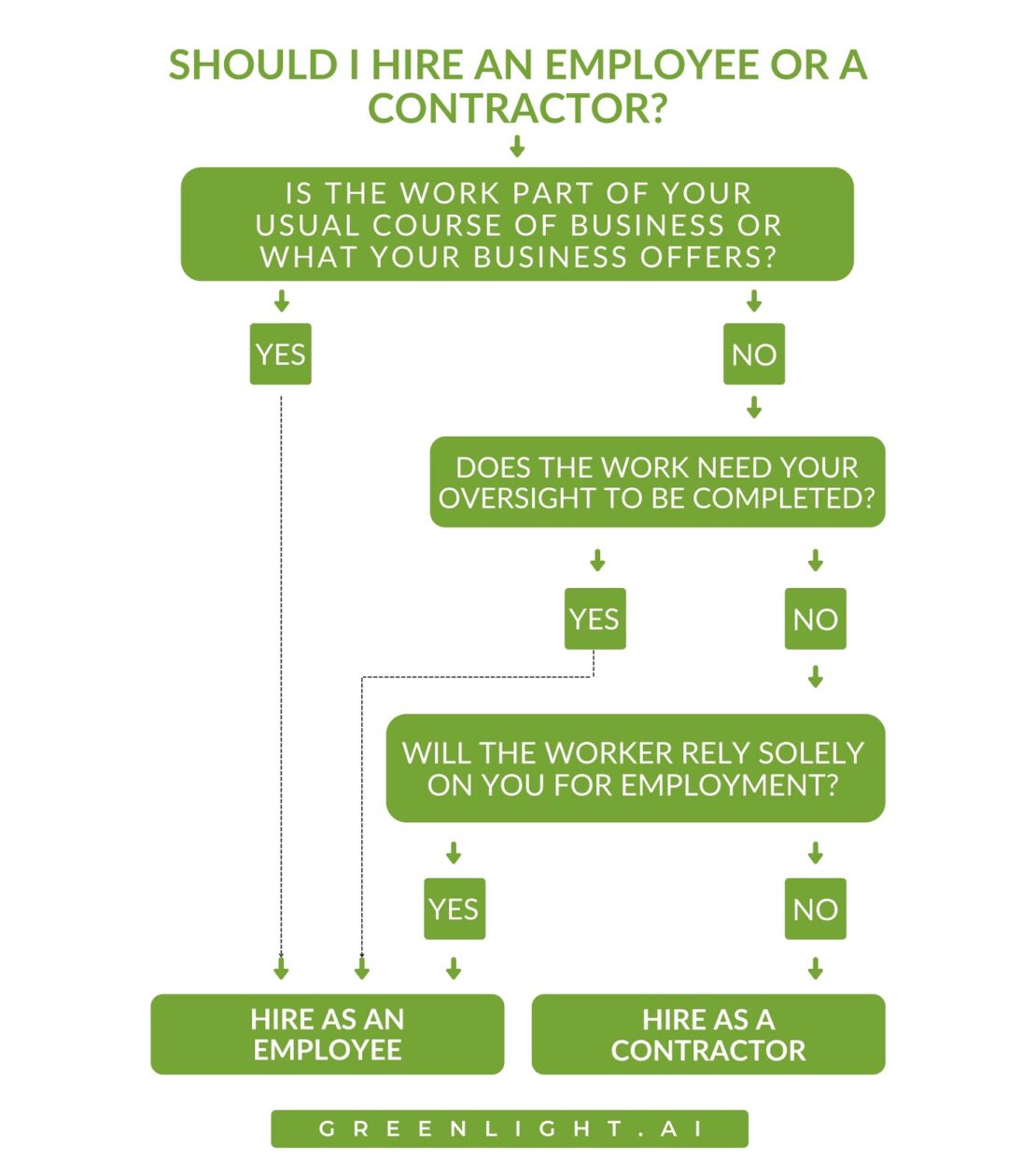

While it’s impossible to know for certain without consulting an expert, we’ve created the following chart based off the ABC test to help you decide whether you’re hiring a contractor or employee.

At the end of the day, this chart is a guide for gaining clarity, and businesses should consult with an experienced accountant, attorney, or our team of experts for more specific advice.

As you can see from this chart, the new legal precedent makes it tough for a worker to qualify as an independent contractor. Keep in mind that the word “employee” is a legal status that has little to do with how many hours you work each week or how many weeks you work. The next section covers how these different classifications affect your bottom line.

How does hiring contractors vs. employees affect my bottom line?

When it comes to hiring employees or contractors, there are many factors that affect your business’s bottom line. When you hire a contractor, the expenses may involve paying for their time, materials, and self-employment taxes. This might not be as expensive as hiring an employee with benefits and a salary. However, hiring workers as employees can also end up being less expensive because you can control their work more than contractors.

The tax liabilities of the different classifications have some of the greatest effects on the bottom line. Hiring an independent contractor doesn’t necessarily save you money on taxes. Let’s take a look at the economic impacts of both classifications.

The Economic Impact of Hiring Independent Contractors

Hiring independent contractors, or 1099 workers, can save you money on overhead such as benefits and office space. This hiring option also gives you the freedom to only bring these workers on board when you need them and for the specific services you need.

However, since independent contractors are responsible for paying self-employment taxes, these costs can be added to their project fees, so you don’t necessarily end up saving money on payroll taxes in the long run. In the case of hiring contractors through Upwork, you must note that Upwork takes 5% to 20% when a worker bills a client, so the worker’s hourly rate or flat project rate may account for this percentage being taken, too.

The Economic Impact of Hiring Employees

Hiring employees, or W2 employees, allows you to assign specific tasks at will and rely on someone who is dedicated to working for your company. Learning company culture and training materials make employees valuable investments that are worth the overhead.

However, since employees only have half of the payroll taxes taken from their paychecks, the employer is responsible for paying the other half of the payroll taxes. Employees also require additional benefits such as health insurance, PTO, overtime pay, and more.

To learn more about the benefits of hiring contractors vs. employees, check out one of our recent articles here.

In Conclusion

The classification of a worker as an employee or contractor has a significant impact on both the business and the worker. Businesses that incorrectly classify workers can face legal action and be forced to pay back wages, while workers miss out on benefits they are entitled to. It is important for businesses to understand all of their hiring options so they can make informed decisions about how to structure their workforce.

If you’d like the best talent for the job but also have concerns about the economic impact of hiring them compliantly, consider an Employer of Record like GreenLight. You can focus on your team while we take care of the rest. We handle payroll, benefits, risk mitigation, and compliance so that you have more time to build a world-class team.

Interested in seeing how it works? Book a demo with our team of experts today so you can easily start hiring, classifying, and paying your workers correctly.